This BBC article reports that the Chinese gov. has had some success in using tight monetary policy to control inflation. Inflation is defined. Monetary policy, government intervention using interest rates and money supply has worked to some extent, as the inflation has fallen from … to …%. This commentary will explain the causes and consequences of inflation and evaluate the likely success of the Chinese governmental intervention to achieve price stability.

Inflation is problem in China’s economic system. The purchasing value of money is decreases as prices rise and wages stay the same. China is under the type of inflation that is of the worst possible scenario, stagflation, the U.S had felt stagflation during the great depression. As a result, the total aggregate supply of China’s economy is under negative growth.

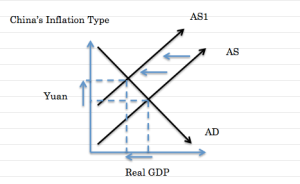

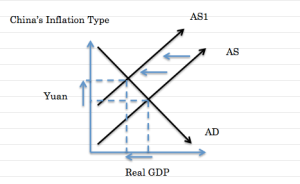

The diagram explains the aggregate supply of China pushed back by the cost-push of inflation. Notice, at the same time, real GDP also decreases, causing two ultimate negative effects. The Chinese Government needed to fix the Yuan prices rising, and GDP dropping. They had administered monetary policy consisting of money supply and interest rates.

The money supply is the money available to stimulate an economy, such as money to spend and borrow. This largely affects the reserve ratio, which is the central banks hold of money in the bank from the companies and the borrowers. When the Chinese government decided to use monetary policy, they tightened the reserve ratio “[raising] the cost of borrowing”, attempts to decrease money flow in the economy.

Additionally, as another implementation to achieve price stability, the Chinese government increased interest rates. The government raised interest rates in order to decrease consumer spending, in order to reach a new equilibrium and price stability. To an extent, they were able to bring down the effects of inflation as “increasing at an annual rate of 11.2%… [have] fallen back from last month’s high of 11.7%.”

The stakeholders of using monetary policy are the companies and industries. Because the reserve ratio increased, companies cannot borrow money, and since the prices are rising, the industries have no choice but to also increase prices. Thus, as a counter effect of China using monetary policy to decrease inflation, the stakeholders who are the companies of China, must adversely increase prices which increases inflation.

Chinese efforts are futile, as investments and consumption have still increased by “25.4% in April, slightly higher than expectations”. The government’s monetary policy is not working. From an economic stand point, the government may have used another policy entitled, fiscal policy. This policy encompasses the utilization of taxation and government spending. The Chinese government may decrease taxation and increase government spending, in attempts to increase aggregate demand and consumer spending to equalize with the current aggregate supply.

Figure B

China, in the long run, can reduce inflation, perhaps not the rising prices, but the real GDP would equalize. As a result, depending on the government, in order to fix unemployment in the long run, fiscal policy can be implemented as a way for proper government intervention. If not, the Chinese economy may be stuck at NAIRU (non- accelerating inflationary rate of unemployment, which is the rate of unemployment that exists when inflation is constant (non-accelerating). Currently, the pros and cons of their policy is currently favored towards cons. With fiscal, the pros will be favored, as long as viewed in Monetarist perspective. Thus, in the long run, constantly increasing aggregate demand will drive the aggregate demand to new equilibrium point in which the economy has reached stability.